Monday, May 31, 2010

AUDUSD

I decide to take some off the table with 20 pips profit at 0.8375 before AUD rate decision at 12:30am.

Sunday, May 30, 2010

Ratio Spread or Reverse Ratio Spread (Backspread)

Both strategies have neutral to bullish bias. But which one is better? Let's analyze. Assume both strategies are credit spreads, which is better one.

Take AAPL as of 05/28/2010 as example, it closed at 256.88 on 05/28/2010.

Ratio Spread

Buys N calls at a lower strike and sells more than N calls at a higher strike.

The maximum profit happens when the underlying closes at the higher strike on expiration date.

Maximum profit point = initial credit + (higher strike - lower strike)

Upside breakeven point = higher strike + Maximum profit point

Here I use 1:2 ratio July calls, notice the margin requirement is $42756.

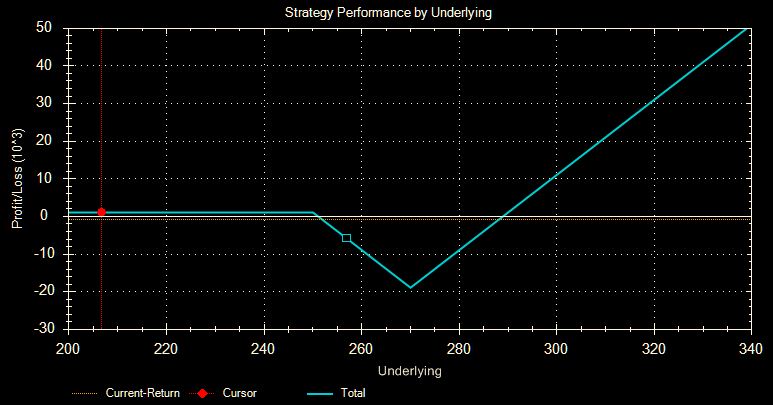

Position summary and P/L graph:

Reverse Ratio Spread

Buy N calls at higher strike and sell less than N calls at lower strike.

Maximum loss happens when the underlying closes at the higher strike on the expiration date.

Max loss = higher strike - lower strike - credit received

Upside breakeven point = higher stike + point of max loss

Downside breakeven point = lower strike

Position:

Position summary and P/L graph, notice the margin is small, $18900

Clearly, backspread favors volatile securities, it expects underlying move up dramatically. It has the following advantages:

1. stock moves up beyond breakeven point by expiration.

2. stock moves up modestly early in the life cycle of the trade.

3. market condition causes IV to move up.

4. stock falls sharply and recovers.

On the other hand, ratio spreader expects underlying move up, but not too much and too quickly.

Finally, the probability shows backspread is somehow like bullish straddle:

Take AAPL as of 05/28/2010 as example, it closed at 256.88 on 05/28/2010.

Ratio Spread

Buys N calls at a lower strike and sells more than N calls at a higher strike.

The maximum profit happens when the underlying closes at the higher strike on expiration date.

Maximum profit point = initial credit + (higher strike - lower strike)

Upside breakeven point = higher strike + Maximum profit point

Here I use 1:2 ratio July calls, notice the margin requirement is $42756.

|

| From misc |

Position summary and P/L graph:

|

| From misc |

|

| From misc |

Buy N calls at higher strike and sell less than N calls at lower strike.

Maximum loss happens when the underlying closes at the higher strike on the expiration date.

Max loss = higher strike - lower strike - credit received

Upside breakeven point = higher stike + point of max loss

Downside breakeven point = lower strike

Position:

|

| From misc |

Position summary and P/L graph, notice the margin is small, $18900

|

| From misc |

|

| From misc |

Clearly, backspread favors volatile securities, it expects underlying move up dramatically. It has the following advantages:

1. stock moves up beyond breakeven point by expiration.

2. stock moves up modestly early in the life cycle of the trade.

3. market condition causes IV to move up.

4. stock falls sharply and recovers.

On the other hand, ratio spreader expects underlying move up, but not too much and too quickly.

Finally, the probability shows backspread is somehow like bullish straddle:

|

| From misc |

Thursday, May 27, 2010

Tuesday, May 25, 2010

Monday, May 24, 2010

Sunday, May 23, 2010

Sugar, Soybean, Coffee and Soybean meal

Sugar is working on its way to the channel top. Seasonal trade favors bull heavily.

Soybean is at the bottom of trading range, look for bull setup. Seasonal trade favors bull.

Coffee is between 130 and 140 for some time. Seasonal trade favors one more up before any downside move.

Soybean meal High 2 is working on right now, it should have one more push to 300 area.

|

| From misc |

Soybean is at the bottom of trading range, look for bull setup. Seasonal trade favors bull.

|

| From misc |

Coffee is between 130 and 140 for some time. Seasonal trade favors one more up before any downside move.

|

| From misc |

Soybean meal High 2 is working on right now, it should have one more push to 300 area.

|

| From misc |

Thursday, May 20, 2010

Wednesday, May 19, 2010

Tuesday, May 18, 2010

EURUSD box trade

EU and GU clearly were forming bear flag during early US session.

It's getting easy. Equity market should have sharp rally into close.

It's getting easy. Equity market should have sharp rally into close.

|

| From misc |

Monday, May 17, 2010

Sunday, May 16, 2010

It's getting easy

Sometimes you win small, sometimes you win BIG.

EU has 1.2225 as weekly support; but it should head to 1.2 first, eventually 1.0

GU has 1.4233 as weekly support.

EU has 1.2225 as weekly support; but it should head to 1.2 first, eventually 1.0

GU has 1.4233 as weekly support.

|

| From misc |

Friday, May 14, 2010

Support turns to resistance

EU continues to form stair down pattern.

It should drop more during Asian session on Sunday night, unless something big happens over the weekend.

It should drop more during Asian session on Sunday night, unless something big happens over the weekend.

|

| From misc |

Thursday, May 13, 2010

EURUSD and GBPUSD

Wednesday, May 12, 2010

Tuesday, May 11, 2010

Sunday, May 9, 2010

Friday, May 7, 2010

Wedge fail?

Theoretical target for wedge target. But today is range day, which should weigh more than pattern.

.jpg) |

| From misc |

Downward slop channel is bull flag

Thursday, May 6, 2010

May potential trade setup

EUR/USD respects the support at the tick

1.2520, to the tick level. The last 500 pips from 1.3000 is easy to get, no support in between. Now we are in support consolidation zone.

Unlike US stock market, Forex, an unregulated market, behaves more like a regulated market.

Unlike US stock market, Forex, an unregulated market, behaves more like a regulated market.

|

| From misc |

Sybean reached target

Few days ago, when S was at 990 area, 87% of future traders 'thought' S would go higher. And future traders are supposed to be better than equity traders.

Anyway, 95% of them are wrong.

Anyway, 95% of them are wrong.

%20%208_25_2009%20-%205_6_2010.jpg) |

| From misc |

Subscribe to:

Comments (Atom)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)