Monday, December 20, 2010

Sunday, December 5, 2010

Saturday, December 4, 2010

Don’t Outsmart Yourself with Sentimental Nonsense

James Stack, editor of InvesTech Research, explains why bullish sentiment surveys are not the bad omen they've been made out to be.

The problem now, it seems, is that the latest rally has made everyone too bullish. At least that's the story according to the current headlines:

"'Dumb Money' Returns to Stocks," The Wall Street Journal, Nov. 8, 2010

"Market Optimism Is Ominous Sign," The Wall Street Journal, Nov. 18, 2010

A Bank of America/Merrill Lynch poll of fund managers reveals market sentiment at its most bullish level since the April peak. And surveys by both Investors Intelligence and American Association of Individual Investors (AAII) found bullish sentiment at new extremes for the current bull market.

A Stopped Clock is Right Twice a Day

But before battening down the hatches and running for cover—simply because everyone else is becoming too bullish—perhaps we should share with you the rest of the sentiment story.

Some have pointed to the recent cover of Barron's ("Bye-Bye, Bear," Nov. 1, 2010) and other institutional money surveys as evidence that bullish sentiment has reached dangerous extremes. But the historical truth is that the majority of institutional investors are correctly bullish during the majority of a bull market run. They just happen to be wrong at the critical turning points—both top and bottom.

In the last bull market, which extended from October 2002 to October 2007, a similar Barron's cover appeared in May 2003 with the following title and quote:

"A Fresh Start: Say goodbye to three years of stock market losses, the bullish portfolio managers in our latest Big Money poll declare. Why the Dow could rally 10% or more."

That poll of bullish sentiment was not only correct, but the bull market lasted three more years and the Dow gained over 65% before peaking.

The Investor's Intelligence survey of investment advisory services shows a similar leap in bullish sentiment since the August correction low. From the Aug. 26 bottom, the percentage of bullish advisors has almost doubled (from 29% to 56%). That is the highest bullish sentiment of the bull market that started in March 2009. And, as you might expect, it's creating great concern among those who follow the numbers.

Yet here again, one needs to research past data to discover the rest of the story. During the middle and latter portion of bull markets, the majority of investment advisors are "correct" in their bullish outlook. Like their institutional counterparts, they're only wrong (or most wrong) at the critical turning points.

The current 56% bullish reading is not that extreme or ominous. In fact, during the 2002-07 bull market, this Investors Intelligence survey registered a bullish reading of more than 50% for 60% of the run. And it spent one-third of the time higher than 55%.

The AAII shows an even sharper swing in sentiment since the Aug. 26 correction low. At that time, the bullish sentiment had dropped to only 21%—the lowest level since the week prior to the March 2009 bear-market bottom. Today it has almost tripled to 58% in less than three months. Sounds ominous, doesn't it? But as Paul Harvey would say, here's the rest of the story.

The AAII poll is far more volatile than any other survey we have tracked. Extremes can be important—but the bearish extremes are far more important than the bullish extremes.

When the Bears Talk, Pay Attention

In most cases when bullish sentiment drops to 20%, it's time to start thinking in the contrarian camp. However, the same is not true when bullish sentiment dominates the landscape.

The current 58% bullish sentiment might sound extreme until one considers that this same survey registered similar levels repeatedly throughout the second year of the 2002-07 bull market. In fact, if one used the "50% bullish" threshold of this sentiment gauge as a trigger to exit the market, they would have been whipsawed 13 times in the 2002-07 bull market, before the final "correct" warning in October 2007.

Bottom line, while extremes in sentiment can be a useful tool in confirming market bottoms, we have yet to find a sentiment survey that has proven historically reliable at market tops.

Both technical and leading fundamental evidence remains on the side of the bulls. The data from our good friends at the Economic Cycle Research Institute is not forecasting a double-dip recession. Consumer confidence, while nothing to write home about, is holding steady. And the ISM survey of purchasing managers is continuing to register levels consistent with ongoing recovery.

Sunday, November 14, 2010

Monday, November 8, 2010

Wednesday, November 3, 2010

ES post QEII

upside target is still ahead.

Buying breakout only makes a scalp.

|

| From misc |

Sunday, October 17, 2010

Friday, October 15, 2010

Oct 15 e-mini

|

| From misc |

Monday, September 13, 2010

Tuesday, August 31, 2010

Sunday, August 29, 2010

Sep Future Spead Watch List

Buy Dec 10 Soybean Meal / Sell July 11 Soybean Cattle

Buy Feb 11 Lean Hogs / Sell Dec 10 Lean Hogs

Buy Jan 11 Soybean Meal / Sell May 11 Soybean Meal

Buy May 11 Sugar / Sell Sep 11 Sugar

Buy Sep 11 Cocoa / Sell May 11 Cocoa

Friday, August 27, 2010

08/27/2010 US Prelim GDP

ACTION: USD/JPY BUY 1.8% SELL 1.2%

There are talks of an even worse release than the already deeply discounted forecast of 1.5%.

- Better GDP = Risk Appetite: JPY should lose strength immediately, making all JPY pairs move up (GBP/JPY, EUR/JPY, USD/JPY, AUD/JPY), and expect to see USD remaining strong against other majors.

- Worse GDP = Risk Aversion: JPY should gain strength immediately, dragging down the USD/JPY pair. USD should also be weak across the board. If the GDP release drops down significantly, we could see flight for safety movement in the market as USD could actually gain strength on the back of demands for US treasuries. This would be an extreme case if GDP misses expectation by a huge deviation such as 1% or more.

Thursday, August 19, 2010

Thursday, August 12, 2010

Saturday, August 7, 2010

Monday, August 2, 2010

Thursday, July 22, 2010

Friday, July 9, 2010

Thursday, July 8, 2010

Wednesday, July 7, 2010

30 days real time trade posts on Forex

Record:

AUDUSD +27

CADJPY +90

USDJPY +30

AUDJPY +46

AUDJPY +30

AUDUSD +47

AUDUSD +18

AUDJPY +19

AUDJPY +52

AUDJPY +33

AUDJPY +38

AUDJPY +64

AUDUSD -3

All trades are sort of swing trades. Total 12 winners and 1 loser. Pips earned is 491.

Not bad.

Sunday, July 4, 2010

Converting Futures to Forex

GBP/USD, EUR/USD, and AUD/USD:

Go to www.cme.comand click on e-quivalents

Make sure you use the middle section, and choose the currency from the drop down menu.

Add the "Forward Points" to the futures bid/offer to find the forex equivalent.

Example (from today):

EuroFX: -15 forward points (approx.)

Futures bid: 1.2188

Forex equivalent = 1.2188 + (-.0015) = 1.2173

USD/JPY, USD/CHF, and USD/CAD:

FIRST: Calculate the inverse of the futures quote (1/"futures quote"). For example: if CHF futures bid is .7893, inverse is 1/.7893 or 1.2669.

Then go to www.cme.comand click on e-quivalents

Make sure you use the middle section, and choose the currency from the drop down menu.

SECOND: Add the "Forward Points" to the inverted price.

Continuing the CHF example, if the Forward Points = 30 (approx), then forex equivalent = 1.2669 + (.0030) = 1.2699

Friday, July 2, 2010

Thursday, July 1, 2010

Wednesday, June 30, 2010

Tuesday, June 29, 2010

06/29 ES DT

|

| From misc |

Today has some classic textbook setups.

1. Opening big gap down, naturally looking for the 06/09 gap filled at 1151. Today is large range day, so the scalp size is 2 points, instead of 1 point.

2. After sharp down, short at bar 6 LOW 1, for scalp.

3. Bar 9 LOW 2 and bull trap, for MM target.

4. Buy setup is at bar 14, but conservative traders can just wait for short setup.

5. short at EMA area at bar 21, tick forms ND in shorter time frame. ES didn't even touch EMA before going down for at least a scalp. It shows aggressive selling. But Market should have another leg up.

6. Shorts continue to short at EMA at bar 35 and 36, it tested low this time. But it's unlikely for market go straightdown at this point.

7. Bar 57 is EMA gap 1, bar 60 is EMA gap 2. Target is retest the low or forming the new low. Bar 60 is a gift. Stop is the bar high. Still the day is range day so far, at least scalp half position.

8. Bar 65 went down then up, traps both bears and bulls. Normally it means big move ahead.

9. Bar 68 is another excellent entry.

10. At this point, it's reasonable to expect market test 05/25 low and 02/05 low. It broke 02/05 low marginally, then bounce.

Saturday, June 26, 2010

Monday, June 21, 2010

Friday, June 18, 2010

Thursday, June 17, 2010

Wednesday, June 16, 2010

Tuesday, June 15, 2010

Friday, June 11, 2010

ES 06/11 day trade

.jpg) |

| From misc |

1. Open MM to the target.

2. H1 at bar 10 for scalp

3. now it's trend line broken for higher high, 2 legs down is expected.

4. short EMA at bar 25 for scalp

5. bar 27 and 28 are 5 ticks failure in 5 mins chart

6. second entry long at bar 28 is good

7. buy at EMA at bar 32 for scalp

8. short at bar 46 is high probability trade. 2 leg corrective upmove.

9. short at EMA at bar 55

10. bulls should be happy to see bar 59 and 60 took out low of bar 27, 28 and 37 then reversal. Buy at bar 60 for scalp.

11. buy at EMA at bar 66 for scalp

12. doji bar 69 2nd long entry, looks bad, but works good. Upside move broke high of bar 44 and 46 is expected. But eventually bulls made strong break move to make new high.

Thursday, June 10, 2010

Friday, June 4, 2010

Thursday, June 3, 2010

Wednesday, June 2, 2010

Tuesday, June 1, 2010

Monday, May 31, 2010

AUDUSD

Sunday, May 30, 2010

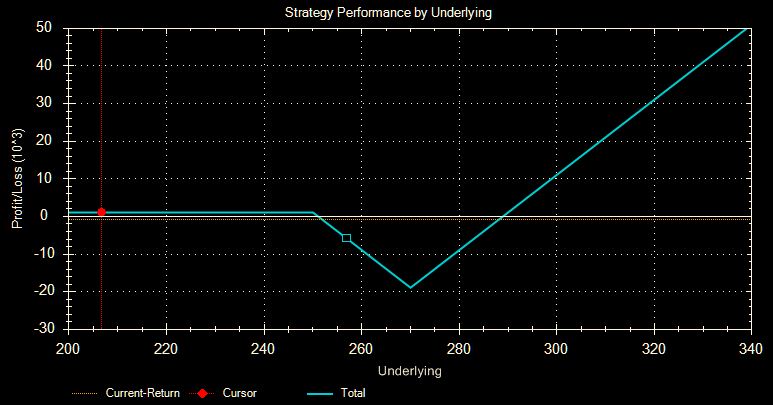

Ratio Spread or Reverse Ratio Spread (Backspread)

Take AAPL as of 05/28/2010 as example, it closed at 256.88 on 05/28/2010.

Ratio Spread

Buys N calls at a lower strike and sells more than N calls at a higher strike.

The maximum profit happens when the underlying closes at the higher strike on expiration date.

Maximum profit point = initial credit + (higher strike - lower strike)

Upside breakeven point = higher strike + Maximum profit point

Here I use 1:2 ratio July calls, notice the margin requirement is $42756.

|

| From misc |

Position summary and P/L graph:

|

| From misc |

|

| From misc |

Buy N calls at higher strike and sell less than N calls at lower strike.

Maximum loss happens when the underlying closes at the higher strike on the expiration date.

Max loss = higher strike - lower strike - credit received

Upside breakeven point = higher stike + point of max loss

Downside breakeven point = lower strike

Position:

|

| From misc |

Position summary and P/L graph, notice the margin is small, $18900

|

| From misc |

|

| From misc |

Clearly, backspread favors volatile securities, it expects underlying move up dramatically. It has the following advantages:

1. stock moves up beyond breakeven point by expiration.

2. stock moves up modestly early in the life cycle of the trade.

3. market condition causes IV to move up.

4. stock falls sharply and recovers.

On the other hand, ratio spreader expects underlying move up, but not too much and too quickly.

Finally, the probability shows backspread is somehow like bullish straddle:

|

| From misc |

Thursday, May 27, 2010

Tuesday, May 25, 2010

Monday, May 24, 2010

Sunday, May 23, 2010

Sugar, Soybean, Coffee and Soybean meal

|

| From misc |

Soybean is at the bottom of trading range, look for bull setup. Seasonal trade favors bull.

|

| From misc |

Coffee is between 130 and 140 for some time. Seasonal trade favors one more up before any downside move.

|

| From misc |

Soybean meal High 2 is working on right now, it should have one more push to 300 area.

|

| From misc |

Thursday, May 20, 2010

Wednesday, May 19, 2010

Tuesday, May 18, 2010

EURUSD box trade

It's getting easy. Equity market should have sharp rally into close.

|

| From misc |

Monday, May 17, 2010

Sunday, May 16, 2010

It's getting easy

EU has 1.2225 as weekly support; but it should head to 1.2 first, eventually 1.0

GU has 1.4233 as weekly support.

|

| From misc |

%20%2012_23_2009%20-%208_6_2010.jpg)