Thursday, July 7, 2011

Thrust again

Another thrust, which is stronger.

MM target is ahead. Bought 1.4295 for 20 ticks.

|

| From misc |

Initial thrust

after strong initial movement, the chance is high there will be follow through.

H1, or H2 would be good for 20 ticks.

EURUSD has more up to go, short term.

|

| From misc |

Wednesday, July 6, 2011

First day after long off

Monday, April 11, 2011

Thursday, March 31, 2011

EURJPY

It confirms the strong break out.

Daily chart shows this pair breaks out from double bottom (or inverse H&S), MM target is 126-127. Short term target is 120 apparently.

Weekly chart shows it breaks out the long term down trend line, it should move up to the starting area of recent down leg, which is around 127.3

Daily chart shows this pair breaks out from double bottom (or inverse H&S), MM target is 126-127. Short term target is 120 apparently.

|

| From misc |

Weekly chart shows it breaks out the long term down trend line, it should move up to the starting area of recent down leg, which is around 127.3

|

| From misc |

Sunday, March 13, 2011

ES possible bouncing targets, near term

bear channel is bull flag; break out the channel on Fri, now it's testing the channel.

Targets are 1308 and 1317.

Targets are 1308 and 1317.

|

| From misc |

Monday, February 14, 2011

Sunday, February 13, 2011

Monday, January 31, 2011

ES pull back?

Like Apr, it could be in process to form h&s.

Or, 3 push ups. Downside MM target never works that well in this bull market.

Or, 3 push ups. Downside MM target never works that well in this bull market.

|

| From misc |

Sunday, January 30, 2011

Wednesday, January 26, 2011

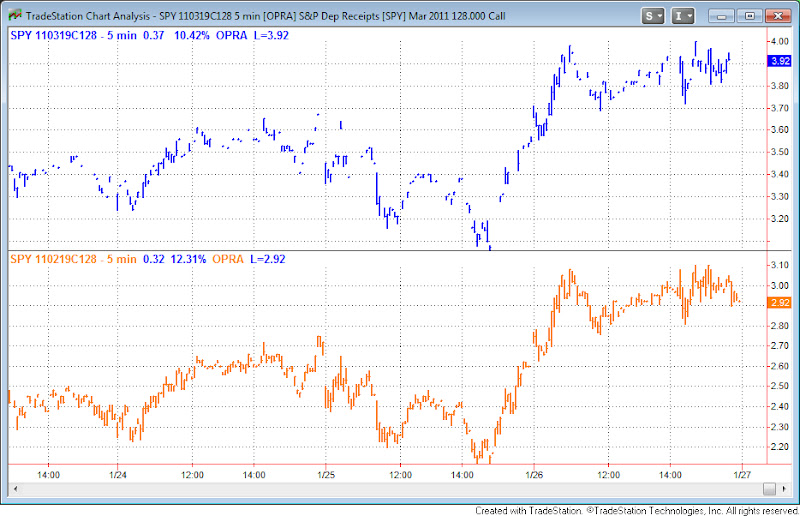

Short term option comparison

Yesterday I longed ATM March call, around $3.18.

Should I choose ATM Feb call, I would get in at around $2.25.

March ATM call gain: $3.93 - $3.18 = 24%

Feb ATM call gain: $3.02 - $2.25 = 34%

10% is counted as insurance fee.

Should I choose ATM Feb call, I would get in at around $2.25.

March ATM call gain: $3.93 - $3.18 = 24%

Feb ATM call gain: $3.02 - $2.25 = 34%

10% is counted as insurance fee.

|

| From misc |

ES reached target

still keep small long for ES 1304. Actually QQQQ is more easier to trade in this rally, it's positioned to test the high.

%20%201_26_2011.jpg) |

| From misc |

Tuesday, January 25, 2011

Sunday, January 23, 2011

Friday, January 21, 2011

EURUSD even number

EU came within few pips to 1.3600 then pull back to ema, that's a gift buy for 15 pips.

There are around 6 ticks difference between spot and future market.

Friday afternoon, it's hard to imagine that players wouldn't take out 1.3600 shorts stop.

MM target is 6E 1.3610 though.

There are around 6 ticks difference between spot and future market.

Friday afternoon, it's hard to imagine that players wouldn't take out 1.3600 shorts stop.

MM target is 6E 1.3610 though.

%20%201_21_2011.jpg) |

| From misc |

Trade of the week

Limit buy at ema at 655.5, got out at MM target, 665.5

Equivalent of ES 10 points in 20 mins.

Equivalent of ES 10 points in 20 mins.

%20%201_21_2011.jpg) |

| From misc |

Thursday, January 20, 2011

Tuesday, January 18, 2011

Sunday, January 16, 2011

ES target zone

probably as their new year resolution, TS charges additionally for SPX cash index.

I decide not to give them the satisfaction. Here is the ES reference chart.

I decide not to give them the satisfaction. Here is the ES reference chart.

|

| From misc |

Sunday, January 9, 2011

Thursday, January 6, 2011

Wednesday, January 5, 2011

Tuesday, January 4, 2011

MM down to the target

reasonable swing long position opening area.

There is no pullback in up move.

Longed from 1259.25, closed at 1265.5

There is no pullback in up move.

Longed from 1259.25, closed at 1265.5

|

| From misc |

Monday, January 3, 2011

Sunday, January 2, 2011

Subscribe to:

Posts (Atom)

%20%201_31_2011.jpg)

%20%201_25_2011.jpg)

%20%201_14_2010%20-%201_14_2011.jpg)